The retail industry uses Axonify to onboard faster, close skill gaps, improve product knowledge, drive sales, serve customers and prioritize operational efficiencies—and the results are impressive.

An LMS delivers retail training. We deliver results.

Enable retail associates to deliver memorable customer experiences, drive sales and prioritize loss prevention with a solution purpose-built for them.

Retail success starts with frontline success

Associate training and enablement needs to be simple, fast and engaging, fit into the flow of work and help retail associates deliver memorable customer interaction, every day. Axonify is the go-to enablement solution for leading retailers because it’s science-backed and proven to maximize the potential of retail workforces.

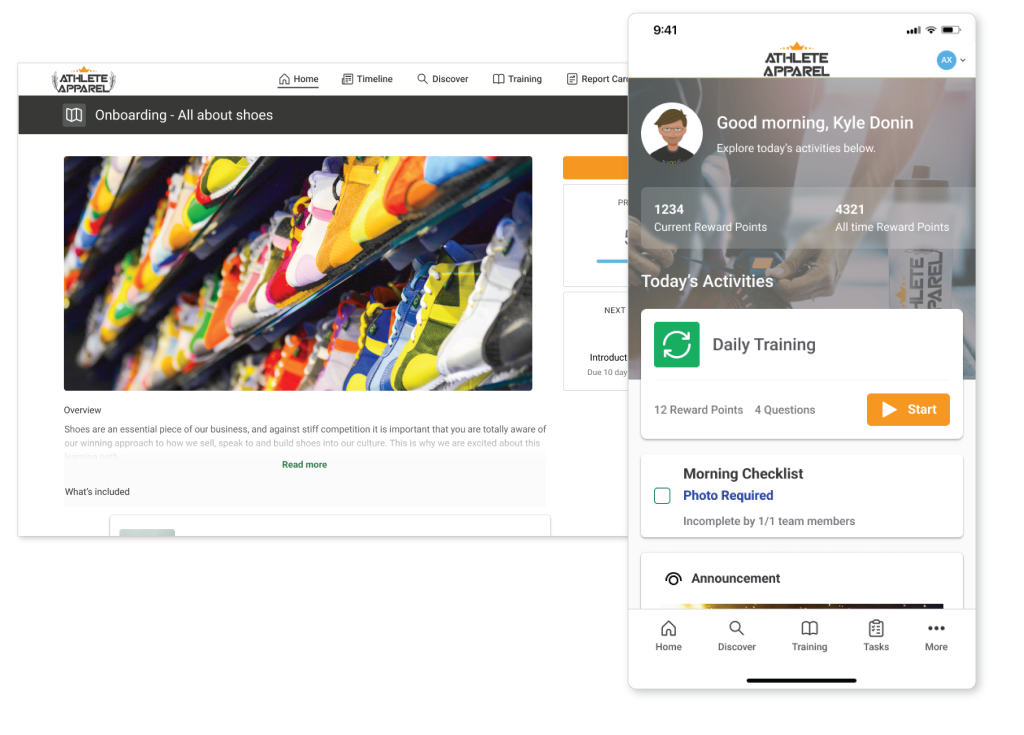

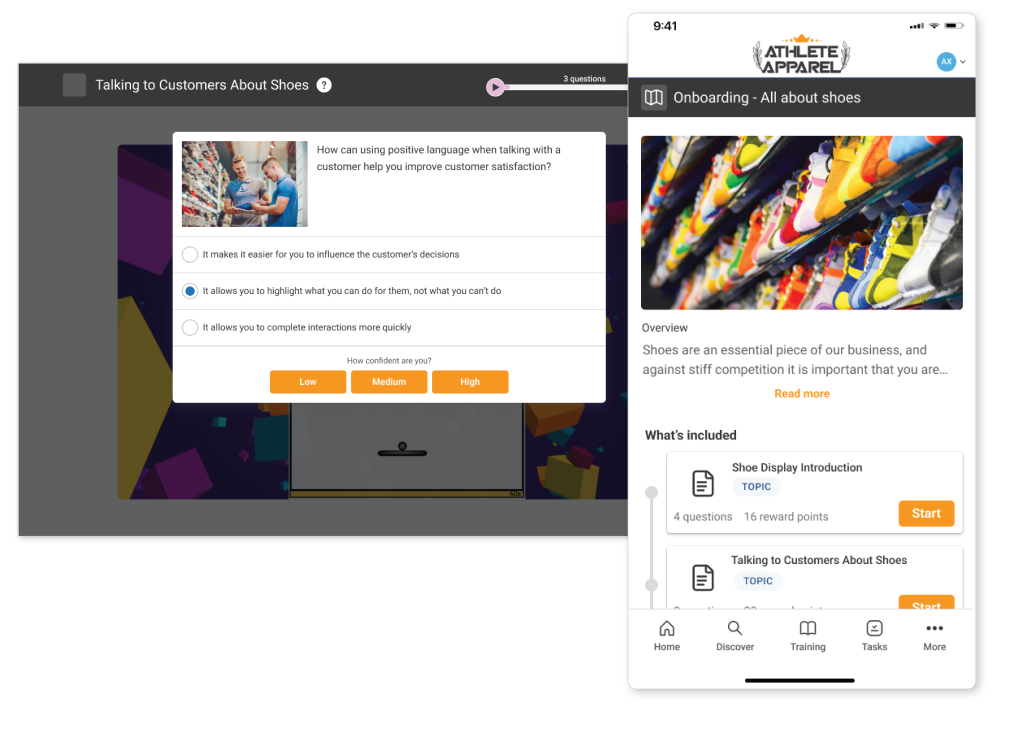

Onboard retail employees fast in the flow of work

We make learning a daily habit because our platform is designed to fit into your associates’ routine: clock in, Axonify, get to work. We use brain science and AI to drive knowledge retention through personalized microlearning and daily intelligent reinforcement so that your people can get the training they need to deliver meaningful customer interactions.

Reach every associate, across every location, in 60+ languages

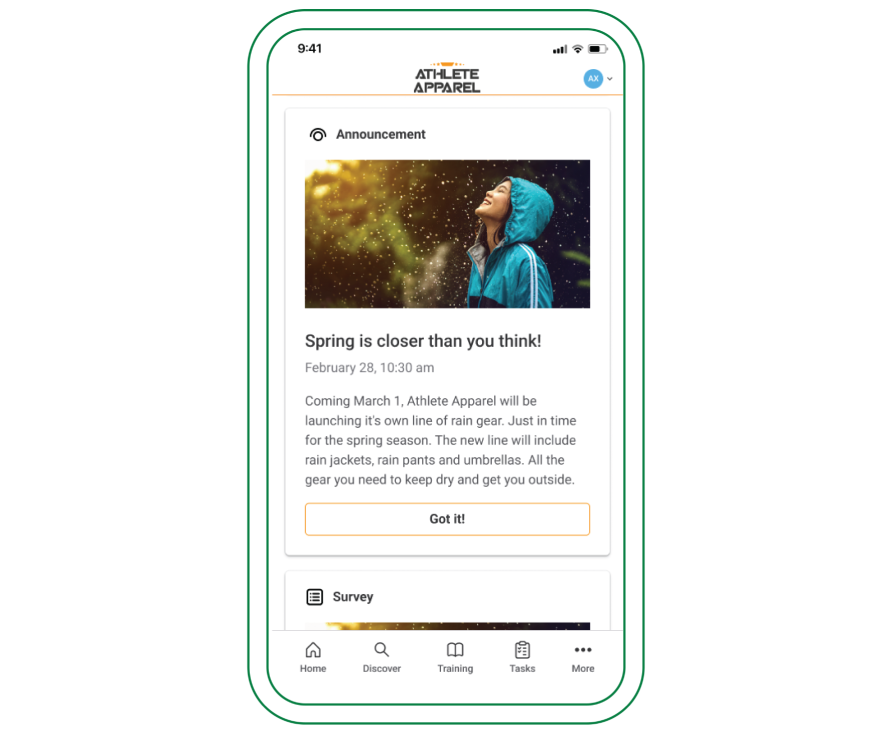

Embedded communication and feedback channels ensure you’re connected to your entire retail workforce, across all your retail stores, in real time. Share critical information, update retail sales staff on product knowledge, promotions and sales, and collect valuable customer insights and best practices—all from one place.

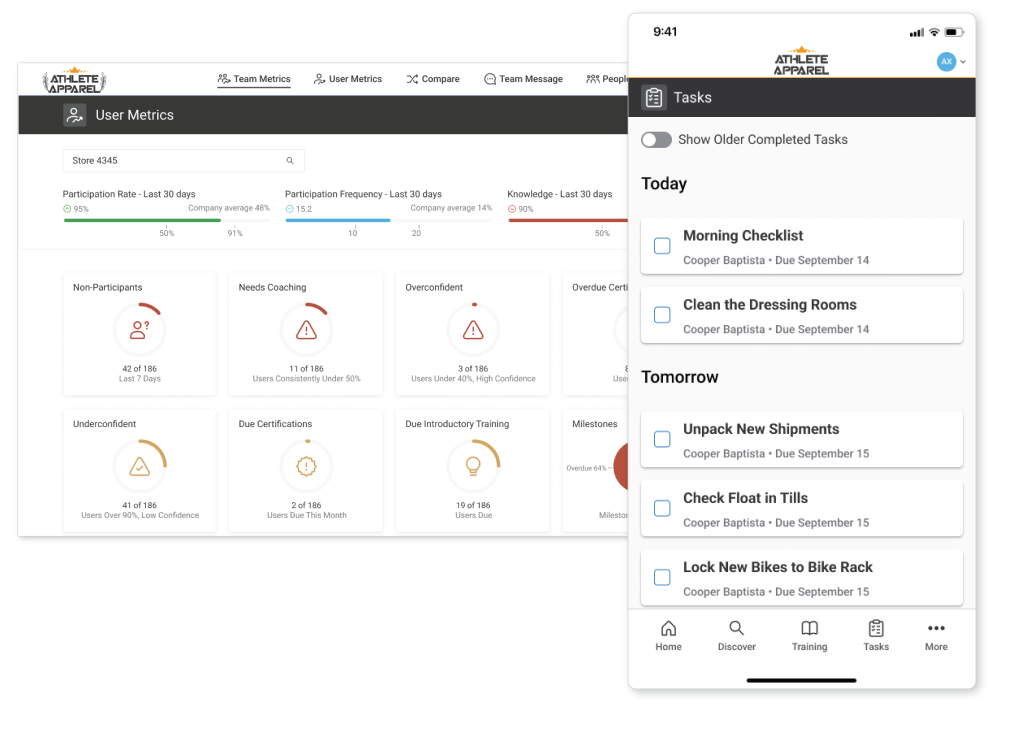

Empower retail sales associates to get it done

Retail operations are complex and dynamic. Task assignments and checklists ensure that your associates know exactly how to put their training to use to deliver results, every day. Robust data provides insights on your people, their skills and tasks, so you can make outcome-based decisions that drive the business.